Image Source: Google

Swing trading stocks can be a lucrative way to maximize your profits in the stock market. It involves buying and holding stocks for a short period, typically a few days to a few weeks, to capitalize on price fluctuations. For beginners looking to get started with swing trading, it's important to understand the basics and develop a solid strategy.

Understanding Swing Trading

What is Swing Trading?

- effective swing trading stocks is a trading strategy that aims to capture short- to medium-term gains in a stock (or any financial instrument) over a period of a few days to several weeks.

- Traders who engage in swing trading typically use technical analysis to identify trends and patterns that can help predict future price movements.

Key Characteristics of Swing Trading

- Short to medium-term holding period

- Relies on technical analysis

- Profit from price swings in the market

Getting Started with Swing Trading

Educate Yourself

- Learn the basics of swing trading, including technical analysis, chart patterns, and risk management.

- Read books, take online courses, and follow reputable trading blogs to deepen your knowledge.

Choose the Right Broker

- Select a reputable online broker that offers competitive trading fees, a user-friendly platform, and access to research tools.

- Consider factors such as customer service, account minimums, and the range of tradable assets.

Develop a Trading Plan

- Define your trading goals, risk tolerance, and investment horizon.

- Set realistic profit targets and stop-loss levels to manage your trades effectively.

Implementing a Swing Trading Strategy

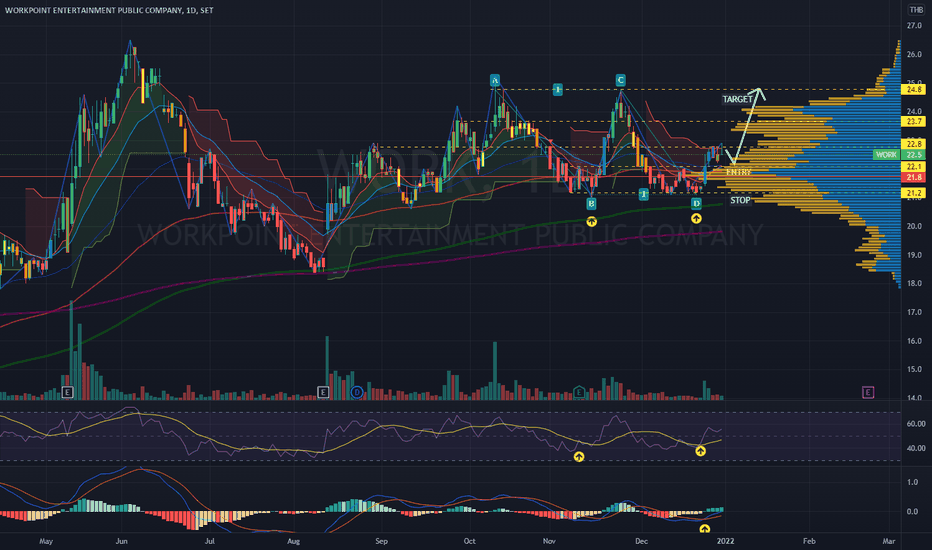

Identifying Entry and Exit Points

- Use technical indicators such as moving averages, RSI, and MACD to identify potential entry and exit points.

- Look for chart patterns such as triangles, flags, and head and shoulders formations to confirm your trading signals.

Managing Risk

- Limit your risk on each trade by setting stop-loss orders to protect your capital from large losses.

- Avoid over-leveraging and only risk a small percentage of your trading account on each trade.

Review and Adjust Your Strategy

- Regularly review your trades and analyze your performance to identify strengths and weaknesses in your strategy.

- Be willing to adapt and make changes to your strategy based on market conditions and feedback from your trades.

Final Thoughts

Swing trading stocks can offer significant profit potential for beginners willing to put in the time and effort to learn the necessary skills. By understanding the basics of swing trading, developing a solid trading plan, and implementing a consistent strategy, you can maximize your profits and achieve your financial goals in the stock market.

Leave a Reply

You must be logged in to post a comment.